10 Tips For Taxfree Tips: A Comprehensive Guide To Keep Your Earnings

10 Tips for Maximizing Tax-Free Earnings: A Comprehensive Guide

Navigating the world of taxes can be daunting, but with the right strategies, you can ensure that a portion of your earnings remains tax-free. In this comprehensive guide, we will explore 10 practical tips to help you keep more of your hard-earned money in your pocket. From understanding tax laws to optimizing your financial planning, let's dive into the world of tax-free tips.

1. Stay Informed About Tax Laws

Tax laws can be complex and often change annually. It's crucial to stay updated on the latest regulations and thresholds to ensure you're taking full advantage of tax-free opportunities. Keep an eye on government websites, consult tax professionals, and subscribe to reputable financial news sources to stay informed.

2. Maximize Your Tax-Free Allowance

Every individual is entitled to a certain amount of tax-free income, known as the personal allowance. This allowance varies by country and can be influenced by factors like age, marital status, and income sources. Ensure you're aware of your specific allowance and structure your earnings accordingly to maximize the tax-free portion.

Example: Personal Allowance in the UK

In the United Kingdom, the personal allowance for the 2023-24 tax year is £12,570. This means that individuals can earn up to this amount without paying any income tax. Any income above this threshold is taxed at different rates, depending on the total income.

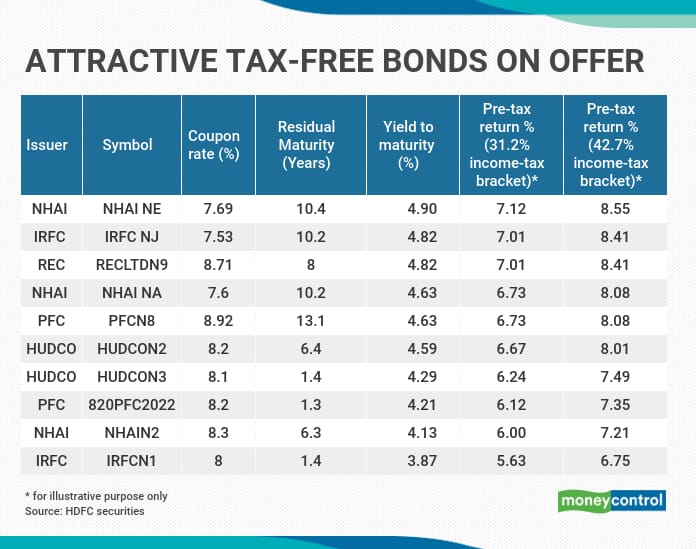

3. Utilize Tax-Efficient Investment Accounts

Investment accounts, such as Individual Savings Accounts (ISAs) in the UK or Roth IRAs in the US, offer a tax-efficient way to grow your wealth. These accounts allow you to invest and withdraw money tax-free, providing a significant advantage over traditional investment methods. Consider opening such accounts to shelter your investments from taxation.

4. Claim Tax Reliefs and Deductions

Many countries offer tax reliefs and deductions for specific expenses or contributions. For instance, you may be eligible for tax relief on pension contributions, charitable donations, or certain business expenses. Ensure you're claiming all the deductions you're entitled to by keeping detailed records and consulting a tax advisor.

5. Optimize Your Pension Contributions

Pension plans are an excellent way to save for retirement while enjoying tax benefits. In many countries, pension contributions are tax-deductible, meaning they reduce your taxable income. Additionally, pension funds often grow tax-free until you withdraw them. Consider maximizing your pension contributions to take advantage of these tax advantages.

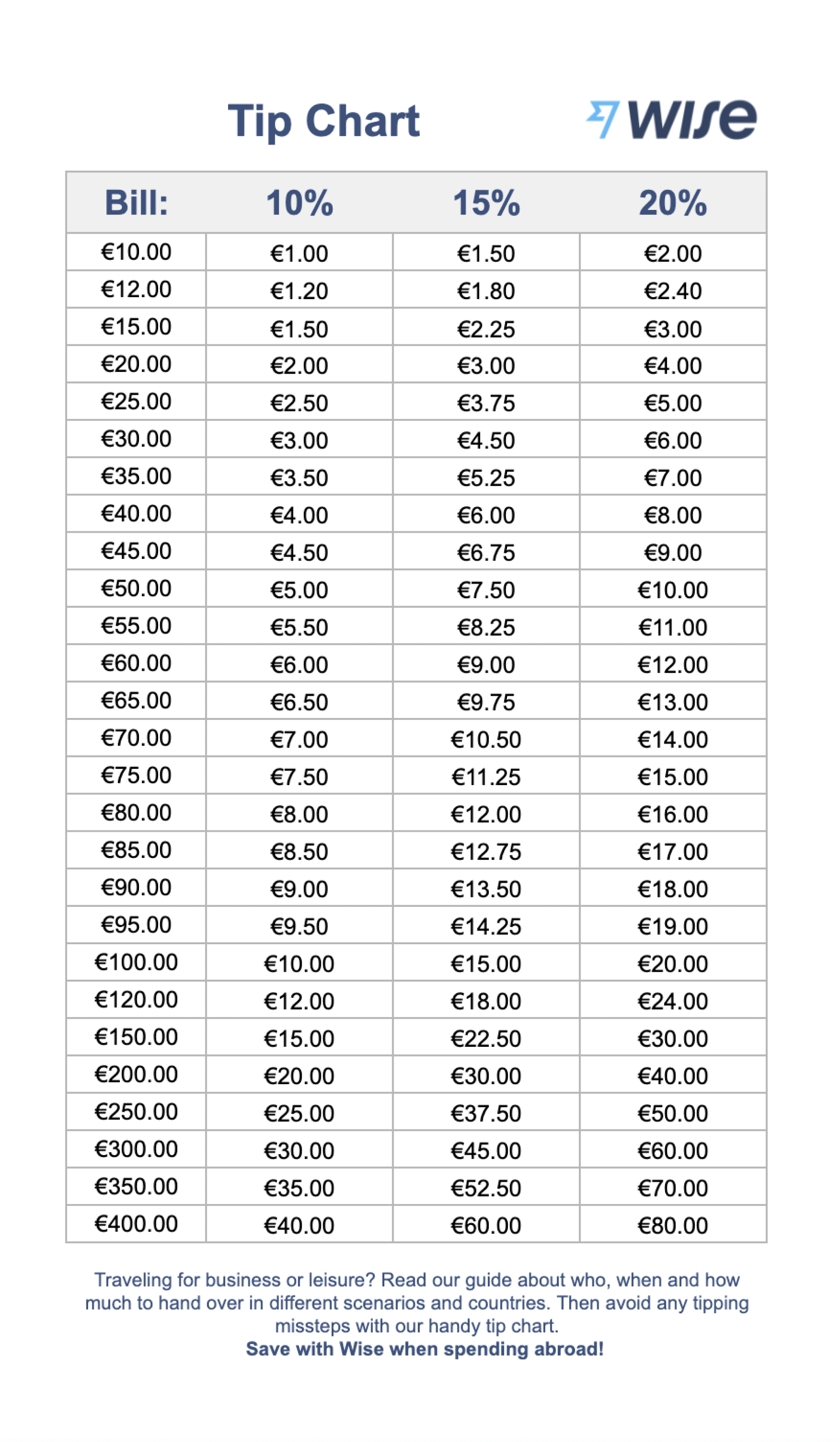

6. Utilize Tax-Free Shopping Events

Keep an eye out for tax-free shopping events, which are often organized by governments to boost local economies. During these events, you can purchase goods without paying sales tax, resulting in significant savings. Plan your purchases accordingly to make the most of these limited-time opportunities.

7. Take Advantage of Tax-Free Thresholds for Gifts

In many countries, there are tax-free thresholds for gifts. This means you can give away a certain amount of money or assets to others without incurring gift taxes. Strategically utilizing these thresholds can help you transfer wealth to your loved ones tax-free. Consult a tax advisor to understand the specific rules and limits in your jurisdiction.

8. Explore Tax-Free Countries or Jurisdictions

Consider relocating to a country or jurisdiction with favorable tax laws. Some countries offer tax-free status for certain types of income, such as foreign-sourced income or income from specific industries. Research and explore these options to potentially reduce your overall tax burden.

9. Minimize Capital Gains Tax

Capital gains tax is levied on the profit made from selling assets, such as stocks, property, or collectibles. To minimize this tax, consider the following strategies:

- Hold onto assets for the long term, as many countries offer more favorable tax rates for long-term capital gains.

- Utilize tax-loss harvesting, where you sell losing investments to offset gains and reduce your overall tax liability.

- Take advantage of capital gains tax exemptions or allowances, which vary by country and may be based on factors like residence or the type of asset sold.

10. Seek Professional Tax Advice

Tax laws can be intricate, and it's easy to miss out on opportunities or make costly mistakes. Consider seeking advice from a qualified tax professional or financial advisor who can provide personalized guidance based on your specific circumstances. They can help you structure your finances optimally to minimize taxes and maximize your tax-free earnings.

Conclusion

Maximizing your tax-free earnings requires a proactive approach and a good understanding of the tax laws applicable to you. By staying informed, utilizing tax-efficient accounts, claiming reliefs and deductions, and exploring various tax-saving strategies, you can keep more of your hard-earned money. Remember, tax planning is an ongoing process, so stay updated and seek professional advice to ensure you're making the most of your financial opportunities.

What is the difference between tax-free and tax-deferred earnings?

+

Tax-free earnings are completely exempt from taxation, meaning you don’t pay any taxes on them. In contrast, tax-deferred earnings are taxed later, typically upon withdrawal or at a later date. While tax-deferred strategies can provide benefits, tax-free earnings offer a more immediate advantage.

Can I use multiple tax-efficient accounts simultaneously?

+

Yes, you can use multiple tax-efficient accounts, such as ISAs or Roth IRAs, simultaneously. This allows you to maximize your tax-free savings and investments, providing a more comprehensive tax-planning strategy.

Are there any drawbacks to claiming tax reliefs or deductions?

+

Claiming tax reliefs or deductions can sometimes lead to a loss of certain benefits or credits. It’s important to carefully consider your overall financial situation and consult a tax advisor to ensure you’re making the best decision for your specific circumstances.

How often should I review my tax planning strategy?

+

It’s recommended to review your tax planning strategy annually, especially when there are changes in your income, investments, or personal circumstances. Regular reviews ensure you’re staying up-to-date with the latest tax laws and optimizing your financial planning accordingly.

Can I combine different tax-saving strategies for maximum benefit?

+

Absolutely! Combining different tax-saving strategies, such as utilizing tax-efficient accounts, claiming reliefs, and optimizing pension contributions, can lead to significant tax savings. A holistic approach to tax planning can help you maximize your tax-free earnings and overall financial well-being.