Capital One Direct Deposit Issues

Direct deposit is a convenient and efficient way to receive your paycheck, government benefits, or any other regular payments directly into your bank account. However, issues with direct deposit can cause unnecessary stress and financial complications. In this blog post, we'll delve into the common problems associated with Capital One direct deposit and provide you with practical solutions to ensure a smooth and timely deposit process.

Understanding Direct Deposit at Capital One

Capital One, a well-known financial institution, offers a range of banking services, including checking and savings accounts. One of the key features of these accounts is the ability to set up direct deposit. This allows individuals to receive their funds electronically, eliminating the need for physical checks and manual deposit processes.

Direct deposit is a secure and reliable method, as it reduces the risk of lost or stolen checks and provides a faster and more convenient way to access your money. However, like any financial process, it is not immune to potential issues and errors.

Common Direct Deposit Issues with Capital One

While Capital One strives to provide a seamless direct deposit experience, there are several common problems that users may encounter. Understanding these issues is the first step towards resolving them effectively.

1. Delayed Deposits

One of the most frustrating direct deposit issues is delayed deposits. This occurs when your expected payment does not arrive in your account on the scheduled date. Delays can range from a few hours to several days, causing financial strain and uncertainty.

There are various reasons why deposits may be delayed, including:

- Processing times: Direct deposits typically take 1-3 business days to clear, but this can vary depending on the sender and the day of the week.

- Weekend or holiday deposits: If your deposit is scheduled to arrive on a weekend or holiday, it may be delayed until the next business day.

- Account verification: In some cases, Capital One may need to verify your account details before processing the deposit, which can cause a slight delay.

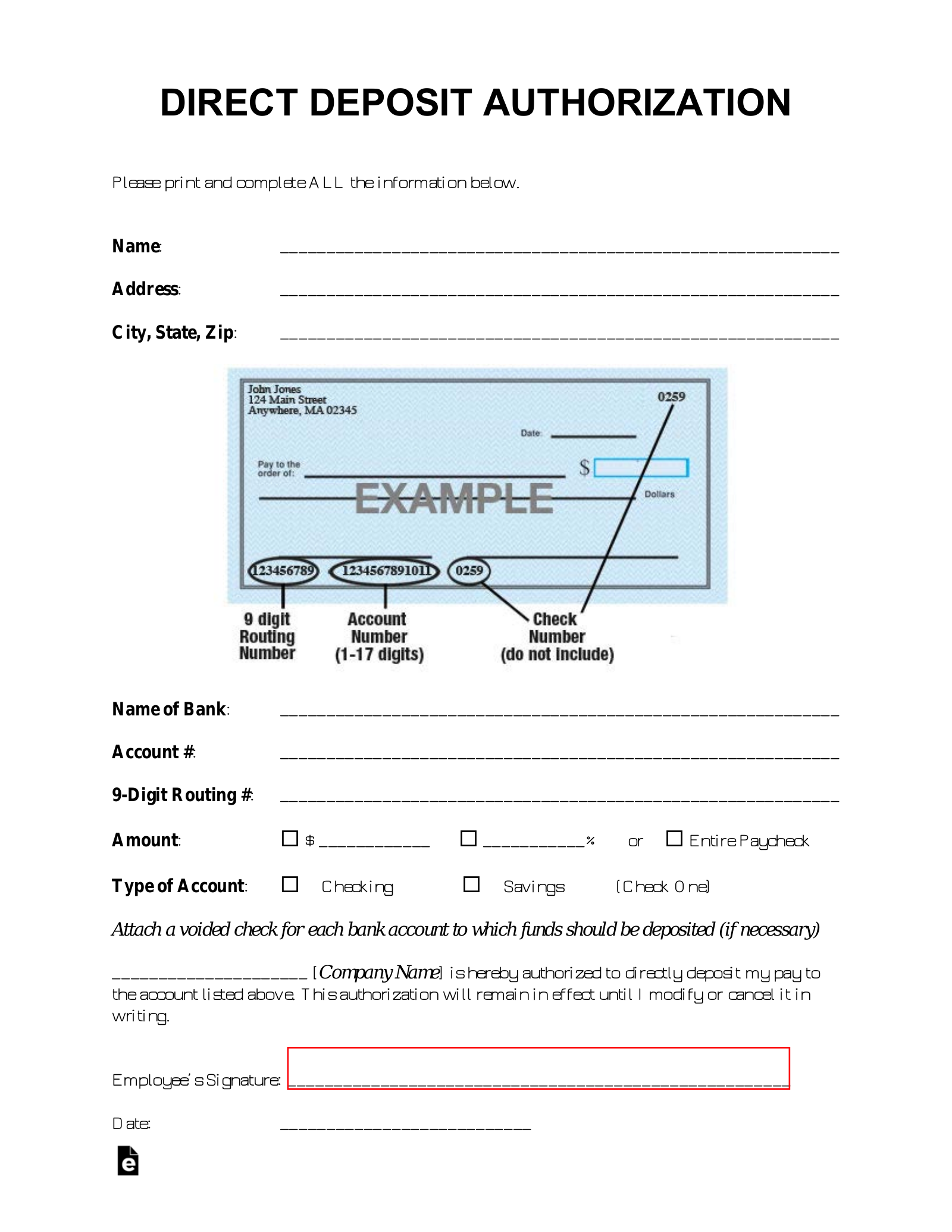

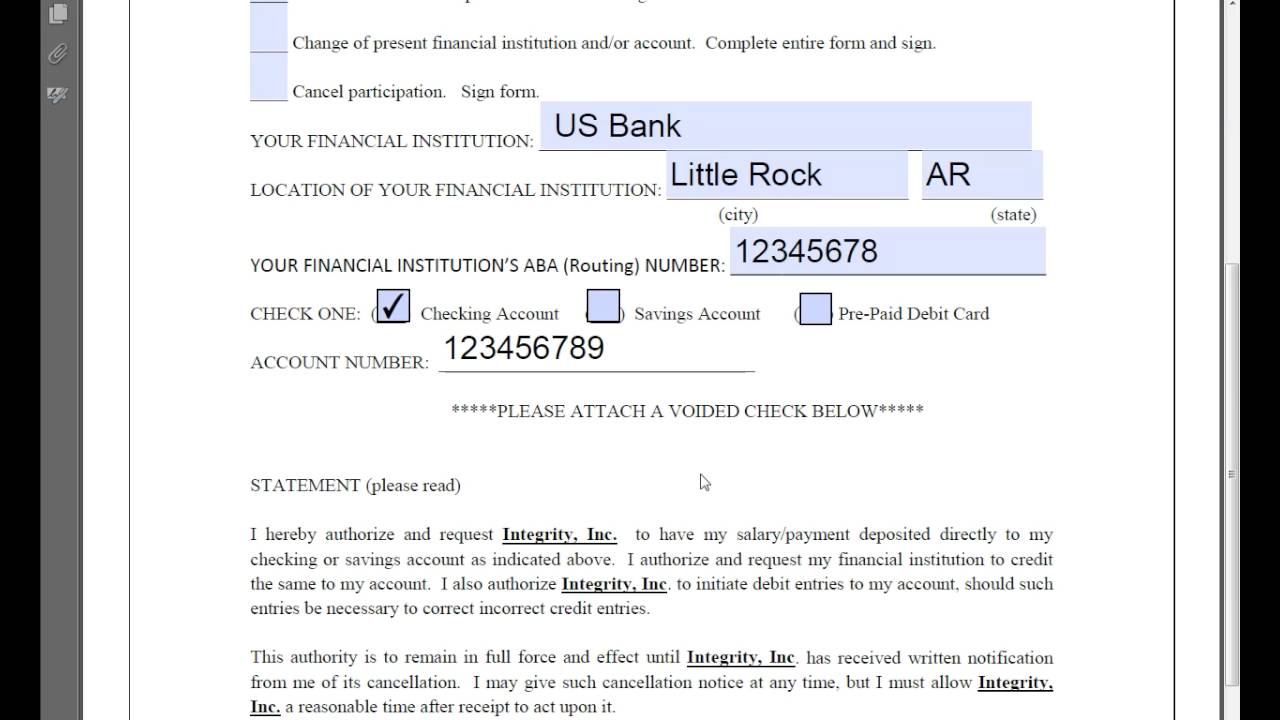

2. Incorrect Account Information

Providing incorrect account information is a common mistake that can lead to direct deposit issues. If the sender has the wrong account number, routing number, or account type, the deposit may be rejected or deposited into the wrong account.

To avoid this problem, double-check your account details with Capital One and ensure that you provide accurate information to the sender. It's always a good idea to confirm the account and routing numbers with your bank before sharing them.

3. Insufficient Funds

Insufficient funds in your Capital One account can also cause direct deposit issues. If there is not enough money in your account to cover the deposit, the transaction may be rejected, resulting in a failed deposit.

To prevent this, ensure that you maintain a sufficient balance in your account to accommodate the incoming deposit. You can also consider setting up overdraft protection or linking a savings account to cover any potential shortfalls.

4. Technical Glitches

Technical glitches or system errors can occasionally occur, impacting the direct deposit process. These issues may be related to Capital One's systems or the sender's banking platform.

If you suspect a technical glitch, it's essential to reach out to Capital One's customer support team. They can investigate the issue, provide updates, and guide you through any necessary steps to resolve the problem.

5. Fraudulent Activity

Unfortunately, fraudulent activity can also affect direct deposits. Scammers may attempt to intercept or redirect your deposits, leading to unauthorized transactions and potential financial loss.

To protect yourself from fraud, regularly monitor your account activity and report any suspicious transactions immediately. Enable two-factor authentication and set up account alerts to stay informed about any changes or unusual activities.

Steps to Resolve Direct Deposit Issues

If you encounter any direct deposit issues with Capital One, here are some steps you can take to resolve them efficiently:

1. Contact Capital One

The first step is to reach out to Capital One's customer support team. They are equipped to handle a wide range of direct deposit issues and can provide guidance tailored to your specific situation.

You can contact Capital One through various channels, including:

- Phone: Call their customer support hotline and speak to a representative.

- Online Chat: Engage in a live chat session on their website.

- Email: Send an email detailing your issue and any relevant information.

2. Provide Accurate Information

When reaching out to Capital One, ensure that you have all the necessary details ready. This includes your account number, routing number, the amount of the deposit, and the expected deposit date.

Providing accurate and comprehensive information will help the support team understand your issue better and expedite the resolution process.

3. Check Your Account Settings

Before contacting Capital One, it's a good idea to review your account settings and ensure that they are correct. Check the following:

- Account type: Verify that the deposit is being sent to the correct account type (e.g., checking or savings).

- Account number: Confirm that the account number provided to the sender matches the one on your Capital One account.

- Routing number: Ensure that the routing number is accurate and up-to-date.

4. Review Deposit History

Access your Capital One online banking or mobile app to review your deposit history. This can help you identify any patterns or recurring issues with direct deposits.

Look for any discrepancies, such as deposits arriving late or in the wrong account. This information can be valuable when discussing your issue with Capital One's support team.

5. Monitor Account Activity

Regularly monitor your Capital One account activity to stay on top of any potential issues. Set up account alerts to receive notifications for deposits, withdrawals, and any other significant transactions.

By keeping a close eye on your account, you can quickly identify and address any direct deposit problems as soon as they arise.

6. Consider Alternative Deposit Methods

If direct deposit issues persist, you may want to explore alternative deposit methods. Capital One offers various options, such as mobile check deposit, wire transfers, and peer-to-peer payment apps.

These methods can provide a temporary solution while you work with Capital One to resolve the underlying direct deposit issues.

Tips for a Smooth Direct Deposit Experience

To ensure a seamless direct deposit experience with Capital One, consider the following tips:

- Provide accurate and up-to-date account information to the sender.

- Maintain a sufficient balance in your Capital One account to avoid deposit failures.

- Set up overdraft protection or link a savings account for added security.

- Regularly review your deposit history and account settings.

- Enable account alerts and two-factor authentication for enhanced security.

- Stay informed about any changes or updates to Capital One's direct deposit services.

By following these tips and staying proactive, you can minimize the chances of encountering direct deposit issues and enjoy a smooth and timely deposit process.

Conclusion

Direct deposit is a convenient and efficient way to manage your finances, but it's not without its challenges. By understanding the common issues associated with Capital One direct deposit and implementing the solutions provided, you can navigate through any obstacles and ensure a smooth deposit experience. Remember to stay informed, monitor your account activity, and reach out to Capital One's support team for assistance whenever needed.

FAQ

How long does it typically take for a direct deposit to clear in my Capital One account?

+Direct deposits typically take 1-3 business days to clear in your Capital One account. However, this can vary depending on the sender and the day of the week.

What should I do if my direct deposit is delayed?

+If your direct deposit is delayed, contact Capital One’s customer support team. They can investigate the issue and provide guidance on resolving the delay.

Can I receive direct deposits into multiple Capital One accounts?

+Yes, you can receive direct deposits into multiple Capital One accounts. Simply provide the relevant account information to the sender for each account.

How can I ensure my direct deposit arrives on time?

+To ensure timely direct deposits, provide accurate account information, maintain sufficient funds in your account, and stay informed about any changes or updates to the direct deposit process.