Design Your Way To The Ultimate 10Step Guide For Gilmour's Wealth

Unveiling the secrets to building a robust financial portfolio is no easy feat, but with the right strategies and a touch of creativity, you can pave your way toward financial success. In this comprehensive guide, we'll explore the 10-step journey to achieving your financial goals, inspired by the iconic Pink Floyd guitarist, David Gilmour. Get ready to straddle the path to financial freedom with a unique twist of artistic flair.

Step 1: Define Your Financial Vision

Just as David Gilmour envisioned his musical journey, you must first define your financial goals. Ask yourself, what do you want to achieve? Is it buying your dream home, starting a business, or securing your retirement? Your financial vision will be your North Star, guiding all your future decisions.

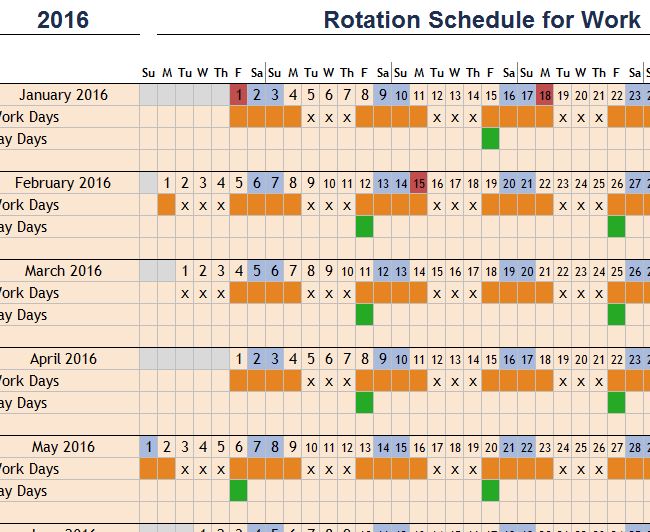

Step 2: Create a Solid Budget

Budgeting is the backbone of financial health. Create a realistic budget that accounts for your income, expenses, and savings. Ensure you allocate funds for your needs, wants, and most importantly, your financial goals. Tools like budgeting apps or spreadsheets can help you track your spending and stay on course.

Step 3: Pay Off Debts Strategically

Debt can be a burden on your financial journey. Develop a plan to pay off your debts, starting with high-interest loans or credit cards. Consider consolidating your debts or negotiating lower interest rates. Freeing yourself from debt will provide financial flexibility and peace of mind.

Step 4: Build an Emergency Fund

Life is full of surprises, and an emergency fund is your safety net. Aim to save enough to cover at least three to six months' worth of living expenses. This fund will protect you from unforeseen events like medical emergencies or job loss, ensuring you don't derail your financial progress.

Step 5: Invest in Yourself

Investing in your skills and knowledge is an investment in your future. Whether it's through education, certifications, or networking, enhancing your expertise can lead to better career opportunities and higher earnings. Remember, your greatest asset is yourself.

Step 6: Diversify Your Investments

Just as David Gilmour diversified his musical talents, diversify your investments. Spread your money across various asset classes like stocks, bonds, real estate, and even alternative investments. Diversification reduces risk and can potentially increase your returns over time.

Step 7: Embrace Long-Term Investing

Financial success is a marathon, not a sprint. Embrace long-term investing strategies to benefit from compound interest and market growth. Set up automatic contributions to your investment accounts and resist the urge to time the market. Consistency and patience are key.

Step 8: Maximize Retirement Savings

Retirement may seem far off, but it's never too early to start planning. Contribute to retirement accounts like 401(k)s or IRAs to take advantage of tax benefits and employer matching contributions. The earlier you start, the more time your money has to grow.

Step 9: Protect Your Wealth

Safeguarding your financial gains is crucial. Purchase adequate insurance coverage for your health, life, and property. This ensures that unexpected events won't deplete your savings or hinder your financial progress.

Step 10: Give Back and Support Causes

Financial success allows you to make a positive impact on the world. Consider supporting causes that align with your values through donations or volunteering. Giving back not only benefits others but also brings fulfillment and purpose to your financial journey.

🌟 Note: Remember, building wealth is a personal journey. Adapt these steps to fit your unique circumstances and financial goals. Stay disciplined, stay creative, and keep strumming towards your financial vision.

Conclusion

Achieving financial success is a multifaceted journey that requires a blend of discipline, creativity, and a touch of artistic flair. By defining your financial vision, creating a solid budget, paying off debts, building an emergency fund, investing in yourself, and diversifying your investments, you'll be well on your way to building a robust financial portfolio. Embrace long-term investing, maximize retirement savings, protect your wealth, and give back to causes you care about. Remember, your financial journey is unique, so adapt these steps to fit your personal circumstances and goals. With dedication and a sprinkle of David Gilmour's creative spirit, you can design your path to financial freedom.

How long does it take to build a substantial financial portfolio?

+

The time it takes to build a substantial financial portfolio varies based on individual circumstances, market conditions, and investment strategies. While some may see significant growth within a few years, others may require a decade or more. Consistency, patience, and a long-term investment horizon are key to achieving substantial financial growth.

What are some common mistakes to avoid when building wealth?

+

Common mistakes to avoid include overspending, neglecting to diversify investments, failing to plan for emergencies, and not taking advantage of tax-efficient retirement accounts. Additionally, avoiding high-interest debt and impulsive investment decisions can help you stay on track towards your financial goals.

How can I stay motivated throughout my financial journey?

+

Staying motivated requires a clear understanding of your financial goals and the impact they will have on your life. Regularly review your progress, celebrate milestones, and surround yourself with a supportive community. Additionally, seeking inspiration from successful individuals and staying informed about financial topics can help keep you motivated.