Fs Workers Explained: The Ultimate Guide To Their Roles And Responsibilities

Understanding FS Workers: A Comprehensive Overview

In the realm of professional services, FS workers play a crucial role, yet their responsibilities are often misunderstood or overlooked. This guide aims to provide an in-depth understanding of who FS workers are, their diverse roles, and the significant contributions they make within various industries.

Who Are FS Workers?

FS workers, an acronym for Financial Services workers, are professionals who operate within the financial services industry. This industry encompasses a wide range of organizations, including banks, investment firms, insurance companies, and more. FS workers are the backbone of these institutions, providing essential services and expertise to ensure smooth operations and deliver value to clients.

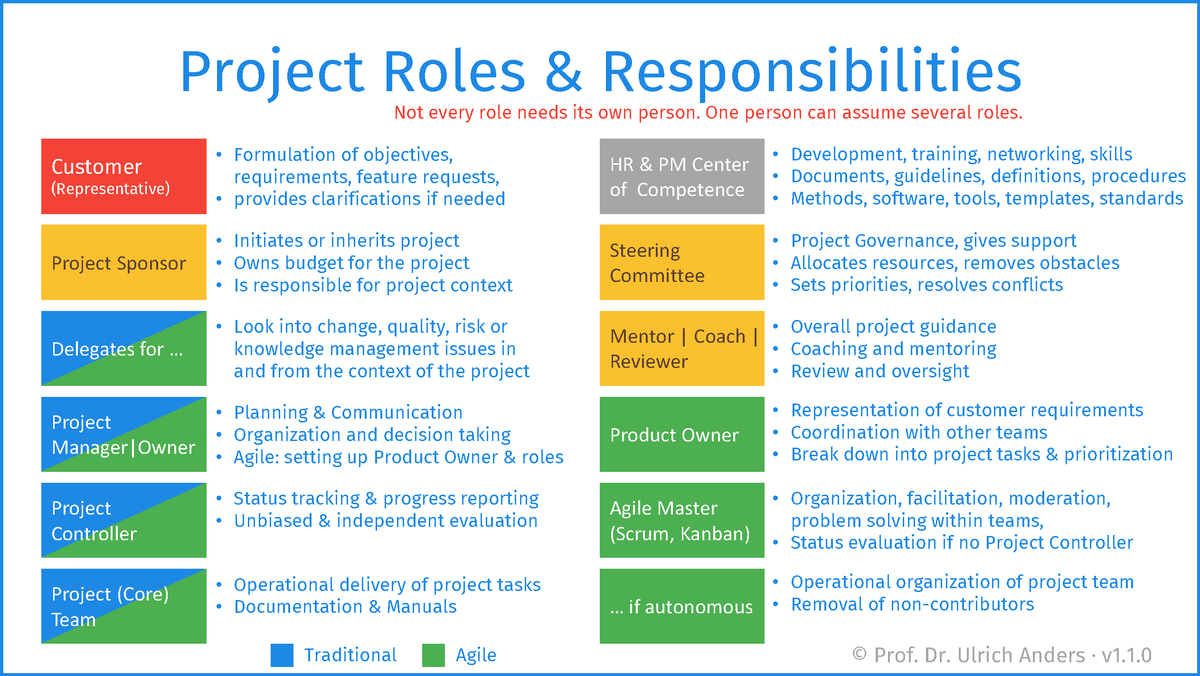

The Diverse Roles of FS Workers

The roles of FS workers are as diverse as the financial services industry itself. Here's an overview of some of the key positions and their responsibilities:

Banking Professionals

- Retail Bankers: These FS workers interact directly with customers, offering guidance on savings, investments, and loans. They are often the first point of contact for individuals seeking financial advice.

- Commercial Bankers: Focused on businesses, these professionals assist companies with their financial needs, including loans, cash management, and strategic financial planning.

- Investment Bankers: Working behind the scenes, investment bankers facilitate mergers and acquisitions, initial public offerings (IPOs), and other complex financial transactions.

Insurance Experts

- Insurance Underwriters: Responsible for assessing the risk associated with insuring individuals or businesses. They determine the likelihood of claims and set appropriate premiums.

- Claims Adjusters: Handle insurance claims, investigating and evaluating the validity of claims, and ensuring fair and prompt payouts to policyholders.

- Insurance Agents: Act as intermediaries between insurance companies and customers, helping individuals and businesses find suitable coverage options.

Investment and Wealth Management

- Financial Advisors: Provide personalized financial planning advice to individuals and families, helping them achieve their short-term and long-term financial goals.

- Wealth Managers: Work with high-net-worth individuals and families to manage and grow their wealth. This involves creating comprehensive investment strategies and offering tax and estate planning advice.

- Portfolio Managers: Responsible for managing investment portfolios, making decisions on buying and selling securities to maximize returns while managing risk.

Regulatory and Compliance

- Compliance Officers: Ensure that financial institutions adhere to all relevant laws and regulations. They develop and implement compliance programs and monitor activities to prevent violations.

- Internal Auditors: Conduct independent audits to assess the effectiveness of internal controls, risk management, and governance processes within financial institutions.

The Impact of FS Workers

FS workers have a significant impact on the financial well-being of individuals, businesses, and the economy as a whole. Their expertise and dedication contribute to:

- Helping individuals achieve their financial goals, such as saving for retirement, buying a home, or funding their children's education.

- Supporting businesses with their financial needs, enabling them to invest in growth, create jobs, and contribute to economic development.

- Ensuring the stability and integrity of the financial system through rigorous compliance and regulatory oversight.

Challenges and Opportunities

The financial services industry is dynamic and ever-evolving, presenting both challenges and opportunities for FS workers. Some key considerations include:

Regulatory Changes

The financial industry is heavily regulated, and compliance with changing regulations is a constant challenge. FS workers, particularly compliance officers, must stay abreast of these changes to ensure their institutions remain compliant.

Digital Transformation

The rise of digital technologies has transformed the financial services landscape. FS workers must adapt to new digital tools and platforms, leveraging them to enhance efficiency and improve the customer experience.

Skills Development

With the industry's evolution, FS workers need to continuously update their skills. This includes staying current with financial products, services, and technologies, as well as developing soft skills like communication and empathy to better serve clients.

Education and Career Path

The path to becoming an FS worker typically involves a combination of education and practical experience. While specific roles may have varying educational requirements, a strong foundation in finance, economics, or business is often beneficial. Many FS workers pursue advanced degrees, such as an MBA or a specialized master's degree in finance or financial planning.

Gaining practical experience through internships or entry-level positions is crucial. This allows aspiring FS workers to apply their knowledge in real-world settings and develop a deeper understanding of the industry. Networking and mentorship can also play a significant role in career development, providing valuable insights and guidance.

Conclusion

FS workers are the unsung heroes of the financial services industry, playing a vital role in the financial well-being of individuals and businesses. Their diverse skill sets and expertise contribute to the stability and growth of the economy. As the industry continues to evolve, FS workers must adapt and stay ahead of the curve, ensuring they remain relevant and effective in their roles.

What are the key responsibilities of FS workers in the banking sector?

+

FS workers in banking have diverse roles, including providing customer service, managing loans and investments, and ensuring compliance with regulations. They are crucial in maintaining the smooth operation of banks.

How do FS workers contribute to the insurance industry?

+

FS workers in insurance assess risks, process claims, and provide customer support. They ensure that policyholders receive fair and timely payouts, contributing to the overall stability of the insurance market.

What skills are essential for a successful career as an FS worker?

+

Strong analytical skills, attention to detail, and a solid understanding of financial concepts are crucial. Additionally, excellent communication and interpersonal skills are essential for building trust and providing effective financial advice.