Mileage Rate 2024

The mileage rate is a crucial aspect for individuals and businesses when it comes to calculating the costs associated with using a vehicle for business-related purposes. The Internal Revenue Service (IRS) in the United States provides standardized mileage rates, which are updated annually, to simplify the process of claiming vehicle-related expenses. In this blog post, we will delve into the mileage rate for the year 2024, its implications, and how it can benefit taxpayers.

Understanding the Mileage Rate

The mileage rate, also known as the standard mileage rate, is a predetermined amount set by the IRS that represents the cost of operating a vehicle for business purposes. It includes expenses such as fuel, maintenance, tires, and depreciation. By using the mileage rate, taxpayers can easily calculate their vehicle-related expenses without the need for extensive record-keeping of actual costs.

The IRS mileage rate is applicable to both businesses and individuals who use their vehicles for business-related activities. It offers a simplified method for claiming deductions or reimbursements, making it an attractive option for taxpayers.

The 2024 Mileage Rate

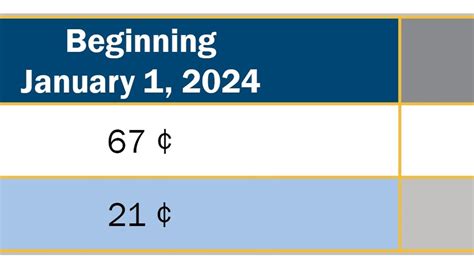

The IRS announced the updated mileage rates for the year 2024, which will come into effect on January 1, 2024. The new rates reflect the changes in fuel prices and vehicle operating costs, ensuring that taxpayers receive fair compensation for their business mileage.

For the 2024 tax year, the standard mileage rates are as follows:

- Business Mileage Rate: $0.62 per mile

- Medical and Moving Mileage Rate: $0.22 per mile

- Charitable Mileage Rate: $0.18 per mile

These rates represent a slight increase from the 2023 mileage rates, indicating the rising costs of vehicle operation.

Calculating Mileage Deductions

To calculate your mileage deductions for business purposes, you can use the following formula:

Total Mileage Deduction = Business Mileage Rate x Total Business Miles Driven

For example, if you drove 10,000 miles for business purposes in 2024, your mileage deduction would be:

Total Mileage Deduction = $0.62/mile x 10,000 miles = $6,200

This means you can claim a deduction of $6,200 for your business mileage expenses on your tax return.

Benefits of Using the Mileage Rate

The mileage rate offers several advantages for taxpayers, making it a popular choice for claiming vehicle-related expenses:

- Simplified Calculation: The mileage rate provides a straightforward and easy-to-calculate method for determining vehicle expenses. You don't need to keep track of individual expenses like fuel purchases or maintenance costs.

- Fair Compensation: The IRS adjusts the mileage rate annually to account for changes in fuel prices and vehicle operating costs. This ensures that taxpayers receive a fair reimbursement for their business mileage.

- Reduced Record-Keeping: By using the mileage rate, you can minimize the need for extensive record-keeping. You only need to keep a log of your business mileage, making tax preparation less time-consuming.

- Flexibility: The mileage rate is applicable to various business-related activities, including sales, service, delivery, and commuting between job sites. It offers flexibility in claiming deductions for different types of business travel.

Using the Mileage Rate for Reimbursements

The mileage rate is not only beneficial for tax deductions but also for businesses that reimburse their employees for business travel expenses. By adopting the IRS mileage rate, businesses can simplify their reimbursement process and ensure fair compensation for their employees' mileage.

When reimbursing employees, businesses can multiply the standard mileage rate by the total number of miles driven for business purposes. This method eliminates the need for employees to submit receipts for individual expenses, streamlining the reimbursement process.

Record-Keeping for Mileage Deductions

While the mileage rate simplifies the calculation of vehicle expenses, it is still essential to maintain proper record-keeping. The IRS requires taxpayers to keep accurate records of their business mileage to support their deductions.

Here are some key records to maintain:

- Mileage Log: Keep a detailed log of your business mileage, including the date, starting and ending odometer readings, purpose of the trip, and the total miles driven. This log should be updated regularly to ensure accuracy.

- Business Purpose: Document the business purpose of each trip. This information is crucial to demonstrate that the mileage is directly related to your business activities.

- Vehicle Information: Keep records of your vehicle's make, model, and license plate number. This information can be used to support your mileage deductions.

By maintaining proper records, you can ensure that your mileage deductions are accurate and comply with IRS regulations.

Alternative Methods for Claiming Vehicle Expenses

While the mileage rate is a convenient option, some taxpayers may prefer to claim actual vehicle expenses. The IRS allows taxpayers to choose between using the standard mileage rate or claiming actual expenses, known as the actual expense method.

The actual expense method involves tracking and deducting individual vehicle-related expenses, such as fuel, maintenance, insurance, and depreciation. This method can be more complex but may be beneficial if your vehicle expenses are significantly higher than the standard mileage rate.

It's important to note that once you choose a method, you must use it consistently for the entire tax year. You cannot switch between methods unless you meet certain criteria, such as disposing of the vehicle or experiencing a significant change in business use.

Conclusion

The 2024 mileage rate provides taxpayers with a simplified and fair way to claim vehicle-related expenses for business purposes. By utilizing the standard mileage rate, individuals and businesses can easily calculate their deductions or reimbursements, reducing the burden of record-keeping. Whether you're a business owner or an employee, understanding and utilizing the mileage rate can help maximize your tax benefits and ensure accurate compensation for business travel.

How often does the IRS update the mileage rate?

+

The IRS typically updates the mileage rate annually, usually in the fall, for the upcoming tax year. The new rates are announced to ensure taxpayers are aware of the changes.

Can I use the mileage rate for personal travel deductions?

+

No, the mileage rate is specifically designed for business-related travel. Personal travel expenses are not eligible for deductions using the standard mileage rate.

Are there any limitations on the number of miles I can claim using the mileage rate?

+

There is no limit to the number of miles you can claim using the mileage rate. However, the IRS may audit your records if your mileage deductions seem excessive or unreasonable.