Student Loans News

The topic of student loans is one that affects millions of individuals worldwide, particularly in countries with high education costs. As the burden of student debt continues to grow, staying updated with the latest news and developments becomes crucial. In this blog post, we delve into the current state of student loans, exploring recent trends, policy changes, and potential solutions to alleviate the financial strain on students and graduates.

The Rising Tide of Student Debt

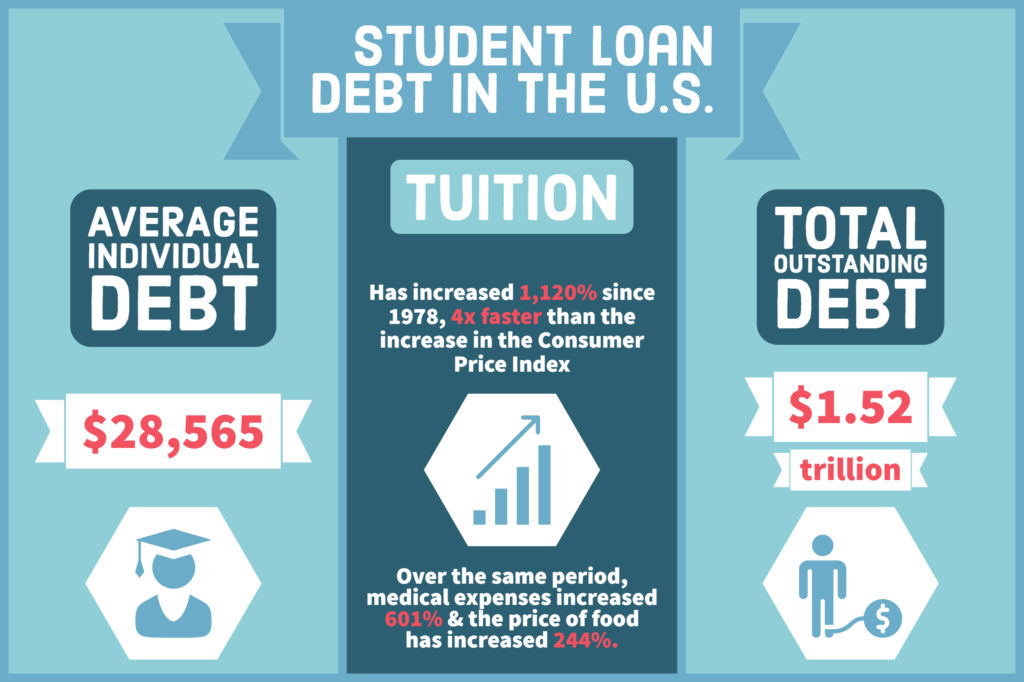

Student loan debt has been on a steady rise over the past decade, reaching unprecedented levels. Many students are now graduating with substantial financial obligations, often surpassing $100,000. This increasing debt load can have significant implications for individuals' financial well-being and their ability to pursue further education or career opportunities.

One of the primary drivers of this debt crisis is the rising cost of higher education. Tuition fees have been increasing at a rate faster than inflation, making it increasingly difficult for students from lower-income backgrounds to afford a college education without taking on substantial loans.

Policy Initiatives and Reforms

Recognizing the gravity of the student loan crisis, governments and educational institutions have begun implementing various policies and reforms to address the issue. Here are some key initiatives:

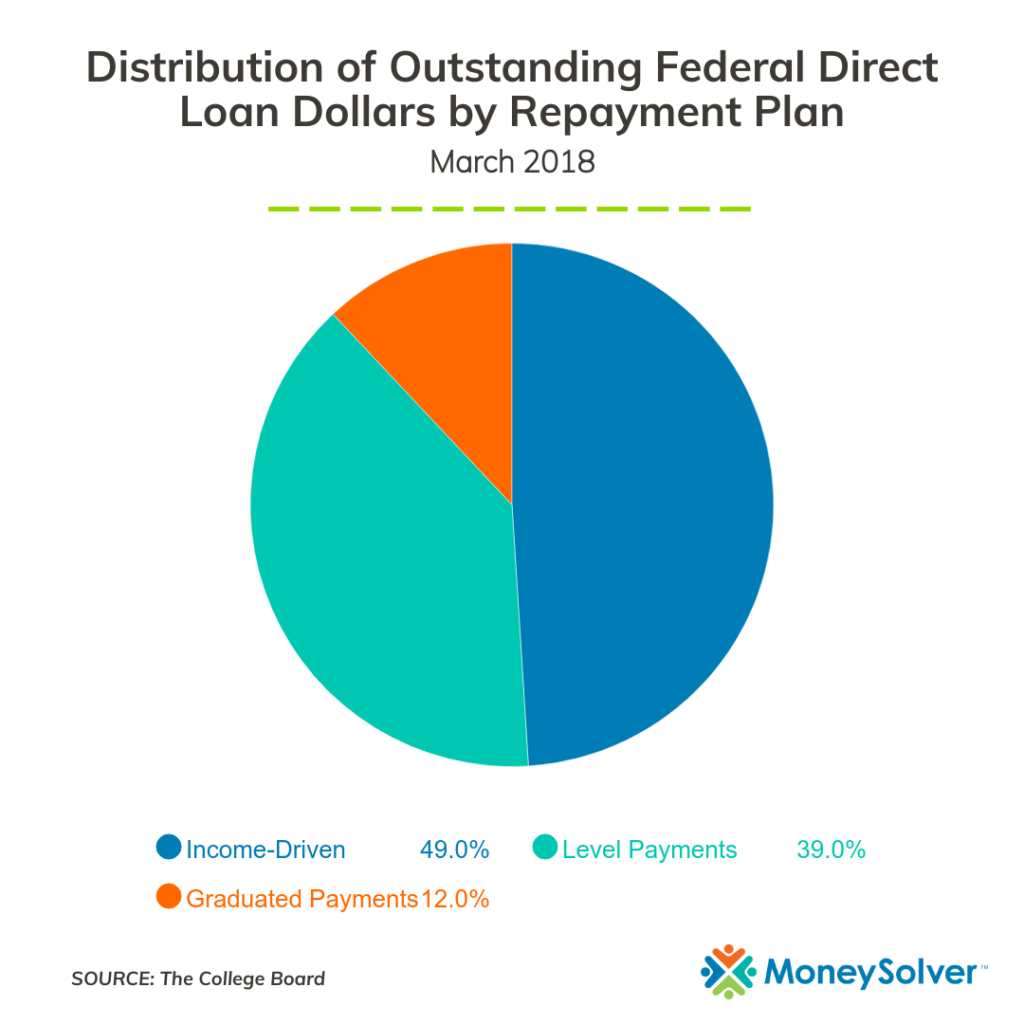

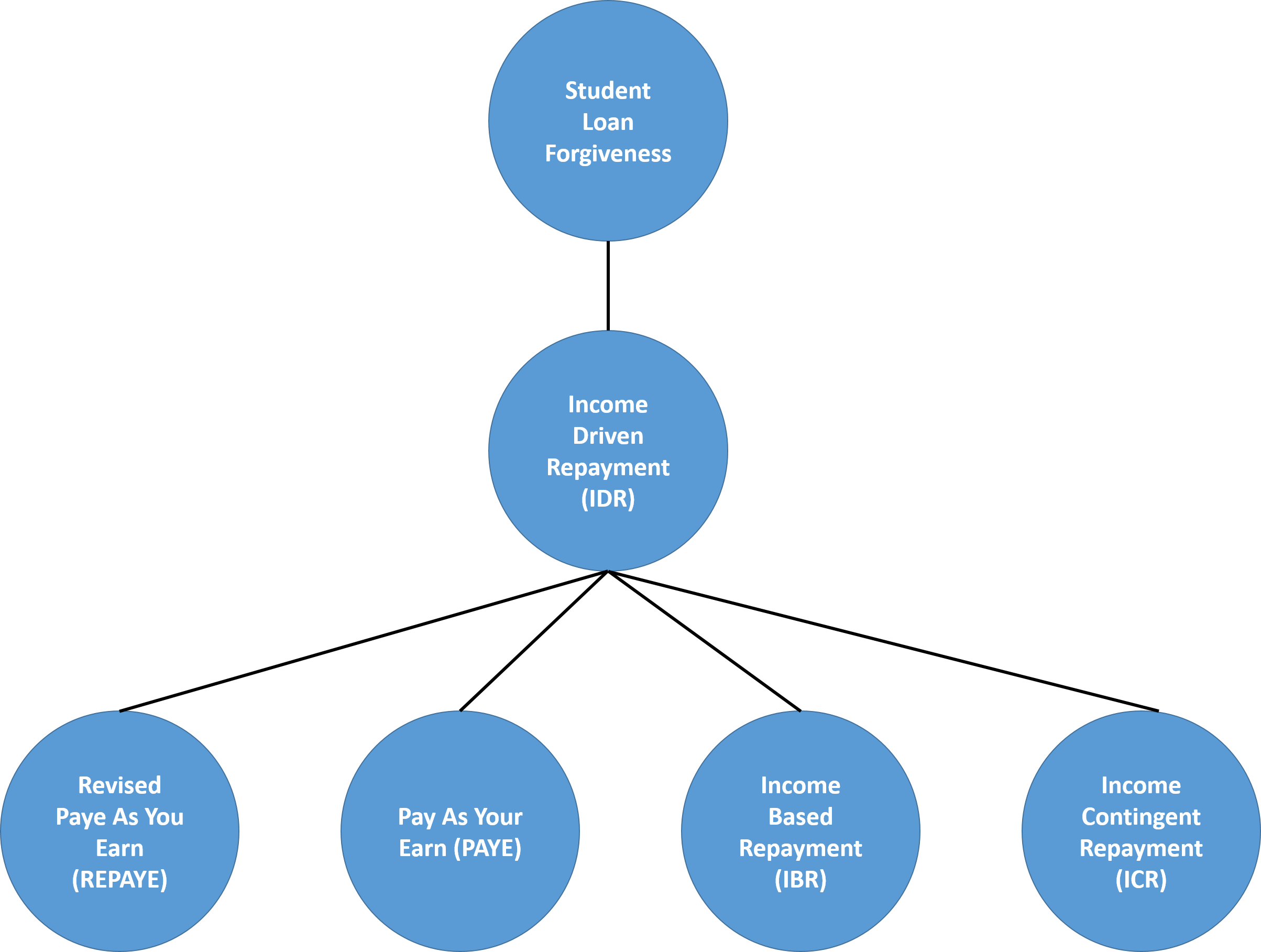

- Income-Driven Repayment Plans: Many countries have introduced income-driven repayment options, where monthly loan payments are calculated based on the borrower's income and family size. These plans aim to make loan repayment more manageable and prevent default.

- Loan Forgiveness Programs: Certain occupations, such as teachers, nurses, and public servants, are eligible for loan forgiveness programs. These initiatives encourage individuals to pursue careers in critical sectors by offering debt relief after a specific period of service.

- Expanded Grant Programs: Governments are investing more in need-based grant programs, providing financial aid to students from low-income families. Grants do not require repayment, making them an attractive alternative to loans.

- Refinancing and Consolidation Options: Students with multiple loans can now refinance or consolidate their debt, often resulting in lower interest rates and more manageable repayment terms.

The Impact of COVID-19

The global pandemic has further exacerbated the student loan crisis. With many graduates facing unemployment or underemployment, loan repayment has become even more challenging. In response, governments implemented temporary relief measures, such as:

- Loan Payment Pauses: Borrowers were granted the option to pause their loan payments without incurring penalties or additional interest.

- Expanded Loan Forgiveness: Some countries expanded their loan forgiveness programs to include individuals who lost their jobs or experienced financial hardship due to the pandemic.

- Interest Rate Reductions: To provide temporary relief, interest rates on federal student loans were reduced to 0% for a limited period.

Student Loan Refinancing: A Viable Option

For graduates with private student loans or those seeking better repayment terms, refinancing can be a viable solution. Refinancing involves replacing your existing loans with a new loan from a private lender, often at a lower interest rate. This can result in significant savings over the life of the loan.

However, it's essential to carefully consider the terms and conditions of refinancing. Private lenders may have stricter eligibility criteria and higher interest rates for those with poor credit histories. It's advisable to shop around and compare offers from multiple lenders to find the best deal.

The Role of Technology in Loan Management

Technology has played a crucial role in streamlining the student loan process and providing borrowers with better tools for management and repayment. Here are some notable developments:

- Online Loan Portals: Many lenders now offer online platforms where borrowers can access their loan information, make payments, and manage their repayment plans conveniently.

- Mobile Apps: Mobile applications have made it easier for borrowers to stay on top of their loan repayment, providing real-time updates and reminders.

- AI-Powered Assistance: Artificial intelligence is being utilized to offer personalized loan repayment advice, helping borrowers make informed decisions about their financial future.

Financial Literacy and Student Loan Education

Promoting financial literacy among students is crucial to preventing excessive borrowing and helping borrowers make informed decisions about their loans. Educational institutions and financial organizations are now offering:

- Financial Literacy Workshops: These workshops aim to educate students about budgeting, managing debt, and understanding the implications of borrowing.

- Online Resources: Many websites and platforms provide comprehensive guides and tools to help students navigate the complex world of student loans.

- One-on-One Counseling: Some institutions offer personalized counseling sessions to assist students in creating repayment plans and exploring loan forgiveness options.

The Future of Student Loans

As the student loan crisis continues to evolve, policymakers, educational institutions, and lenders are working together to find sustainable solutions. Here are some potential future developments:

- Universal Income-Driven Repayment: Some experts advocate for a universal income-driven repayment plan, where all federal loans are automatically enrolled in an income-based repayment program.

- Loan Forgiveness Expansion: There is growing support for expanding loan forgiveness programs to include a wider range of occupations and industries.

- Public-Private Partnerships: Collaboration between government agencies and private lenders could lead to innovative solutions, such as refinancing programs with more favorable terms for borrowers.

Conclusion

The student loan landscape is constantly evolving, and staying informed is essential for borrowers and policymakers alike. While the debt crisis persists, there is a growing recognition of the need for comprehensive reforms and innovative solutions. By combining policy initiatives, technological advancements, and financial education, we can work towards a future where student loans are more manageable and less burdensome for individuals pursuing higher education.

What are the key challenges faced by borrowers with student loans?

+

Borrowers often struggle with high interest rates, complex repayment plans, and the potential for default. The rising cost of education and limited financial literacy can also contribute to these challenges.

How can I find out if I’m eligible for loan forgiveness programs?

+

Research the specific loan forgiveness programs offered by your government or employer. You can also consult with financial advisors or loan servicers to determine your eligibility.

Are there any disadvantages to refinancing my student loans?

+

Refinancing may result in the loss of certain borrower benefits, such as income-driven repayment plans or loan forgiveness programs. It’s important to carefully consider the terms and conditions before making a decision.

How can I improve my financial literacy regarding student loans?

+

Attend financial literacy workshops, utilize online resources, and seek guidance from financial advisors or counselors. Understanding the terms and conditions of your loans is crucial for making informed decisions.

What steps can policymakers take to address the student loan crisis?

+

Policymakers can explore options such as expanding income-driven repayment plans, increasing grant funding, and implementing universal loan forgiveness programs. Collaboration with educational institutions and lenders is also essential.