Trump Child Support Law Taxes

Child support is a legal obligation that parents may have to provide financial support for their children, even after divorce or separation. In the United States, child support laws vary from state to state, and understanding these laws is crucial for parents navigating their financial responsibilities. One notable aspect of child support is its treatment in tax matters, which can impact the financial well-being of parents and their children.

Understanding Child Support

Child support is a crucial aspect of family law, ensuring that children receive the necessary financial resources for their upbringing, regardless of their parents' living arrangements. It is a legal obligation that arises when parents separate or divorce, and it can also be applicable in cases of unmarried parents.

The primary goal of child support is to provide for the child's basic needs, such as food, clothing, shelter, education, and healthcare. It aims to maintain the child's standard of living as closely as possible to what they would have experienced if their parents had remained together.

Child support orders are typically issued by a court and are based on various factors, including the income of both parents, the number of children involved, and the specific needs of the child. These orders outline the amount of financial support that one parent, often the non-custodial parent, must provide to the other parent, who typically has primary custody of the child.

Child Support and Taxes

When it comes to taxes, child support payments can have tax implications for both the paying and receiving parent. It's important to note that the treatment of child support in taxes can vary depending on the jurisdiction and the specific circumstances of each case.

Deductibility of Child Support Payments

In many jurisdictions, including the United States, child support payments are generally not tax-deductible for the paying parent. This means that the paying parent cannot reduce their taxable income by the amount of child support paid. It is considered a personal expense and is not treated as a business expense or charitable contribution.

For example, if a parent pays $1,000 per month in child support, they cannot deduct this amount from their taxable income when filing their taxes. The Internal Revenue Service (IRS) views child support as a legal obligation and not a voluntary donation, hence the non-deductibility.

Taxability of Child Support Receipts

Similarly, in most cases, child support payments received by the custodial parent are not taxable income. This means that the receiving parent does not have to pay taxes on the child support they receive. It is considered a reimbursement for the expenses incurred in raising the child and is not treated as income.

However, it's important to note that there may be exceptions and variations in different jurisdictions. Some countries or states may have specific rules regarding the taxability of child support receipts, especially in cases where the payments are made through a trust or as part of a property settlement.

Alimony vs. Child Support

It's crucial to distinguish between child support and alimony, as they have different tax treatments. Alimony, also known as spousal support, is generally taxable to the receiving spouse and deductible by the paying spouse. This means that the receiving spouse must include alimony payments as income on their tax return, while the paying spouse can deduct these payments from their taxable income.

Child support, on the other hand, is not considered alimony and is treated separately. As mentioned earlier, child support payments are generally neither deductible by the paying parent nor taxable to the receiving parent.

The Trump Administration and Child Support

During the Trump administration, there were some notable changes and discussions surrounding child support laws and their tax implications. While no significant alterations to the tax treatment of child support were made, there were efforts to strengthen child support enforcement and improve the overall system.

Child Support Enforcement

The Trump administration emphasized the importance of child support enforcement, aiming to ensure that non-custodial parents fulfill their financial obligations. They worked towards enhancing the efficiency of the child support system by implementing measures such as:

- Improved Data Sharing: Efforts were made to enhance data sharing between states to better track and locate non-custodial parents who owe child support.

- Enhanced Collection Methods: The administration explored innovative ways to collect child support payments, including the use of private collection agencies and improved wage garnishment processes.

- Increased Penalties: Stricter penalties were proposed for non-custodial parents who failed to meet their child support obligations, with the goal of deterring non-payment.

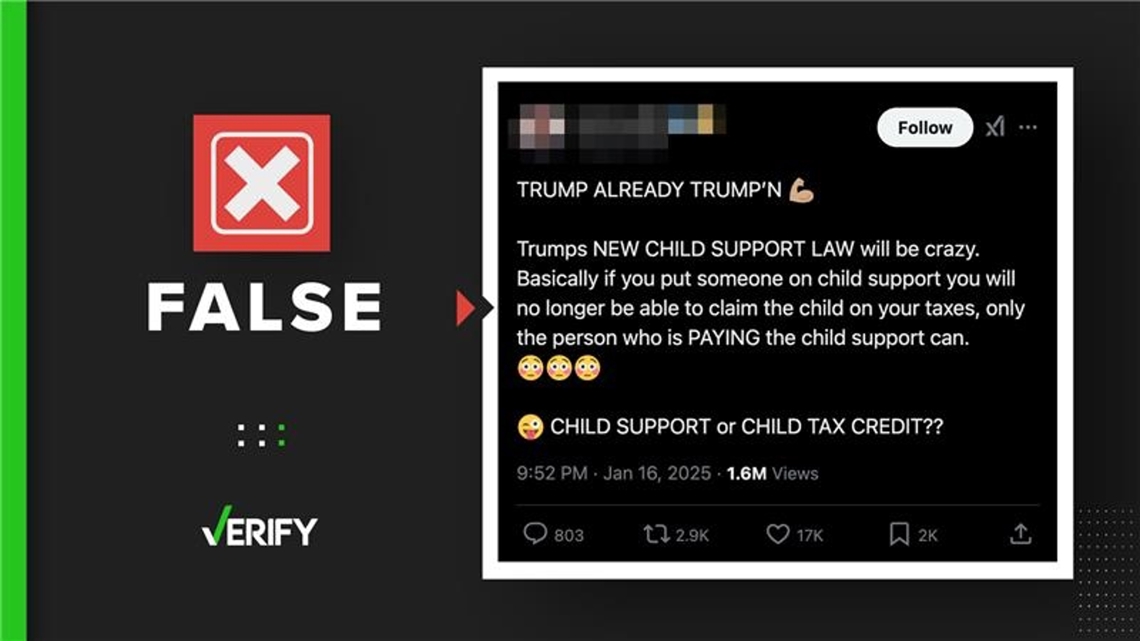

Tax Reform and Child Support

During the Trump administration's tax reform efforts, there were discussions surrounding the potential impact on child support payments. However, no significant changes were made to the tax treatment of child support. The focus remained on simplifying the tax code and reducing tax burdens for individuals and businesses.

It's worth noting that the Tax Cuts and Jobs Act, passed in 2017, did not address the deductibility or taxability of child support payments. The act primarily focused on reducing tax rates, modifying deductions, and simplifying the tax filing process.

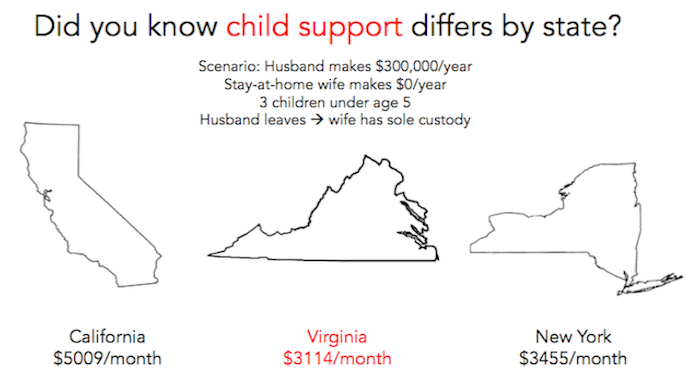

Calculating Child Support

The calculation of child support can vary depending on state laws and guidelines. Generally, child support is determined based on a combination of factors, including:

- Income of Both Parents: The income of both parents is considered when determining the child support amount. This includes wages, salaries, bonuses, and other forms of income.

- Number of Children: The number of children involved in the case affects the child support calculation. Each child has unique needs, and the support amount may be adjusted accordingly.

- Custody Arrangements: The custody arrangement, whether it's sole custody or shared custody, can impact the child support calculation. In some cases, the non-custodial parent may receive a reduction in their support obligation if they have significant parenting time.

- Child-Related Expenses: The court may consider additional child-related expenses, such as healthcare costs, childcare expenses, and educational fees, when determining the child support amount.

It's important to consult with a family law attorney or seek guidance from your state's child support enforcement agency to understand the specific child support guidelines and calculation methods in your jurisdiction.

Enforcing Child Support Orders

Enforcing child support orders is crucial to ensure that children receive the financial support they are entitled to. If a non-custodial parent fails to make the required child support payments, there are various enforcement mechanisms in place to address the issue.

Wage Garnishment

One common method of enforcing child support orders is through wage garnishment. This involves the court ordering the non-custodial parent's employer to withhold a portion of their wages to satisfy the child support obligation. The garnished amount is then sent directly to the custodial parent or the child support enforcement agency.

Interception of Tax Refunds

In some cases, the child support enforcement agency can intercept the non-custodial parent's tax refund to apply it towards their outstanding child support debt. This ensures that the parent prioritizes their child support obligations over receiving a tax refund.

Passport Denial

As a measure to encourage child support payment, some jurisdictions may deny or restrict the issuance of a passport to a non-custodial parent who has fallen significantly behind on their child support payments. This can limit their ability to travel internationally until the debt is resolved.

Driver's License Suspension

In certain states, non-payment of child support can result in the suspension of the non-custodial parent's driver's license. This is done to incentivize parents to meet their financial obligations and provide for their children.

Modifying Child Support Orders

Child support orders are not set in stone and can be modified under certain circumstances. If there is a significant change in circumstances, such as a substantial increase or decrease in income, a change in custody arrangements, or a significant change in the child's needs, a parent can request a modification of the child support order.

To modify a child support order, a parent typically needs to file a motion with the court, providing evidence of the changed circumstances. The court will then review the request and make a decision based on the best interests of the child.

Conclusion

Child support is a vital aspect of family law, ensuring that children receive the financial support they need for their upbringing. While the tax treatment of child support payments remains largely unchanged, with payments generally being non-deductible and non-taxable, the Trump administration's focus on child support enforcement aimed to strengthen the system and hold non-custodial parents accountable. Understanding the legal obligations and tax implications of child support is essential for parents navigating this complex area of family law.

Can child support payments be deducted from taxes?

+

No, child support payments are generally not tax-deductible for the paying parent. They are considered a personal expense and are not treated as a business expense or charitable contribution.

Are child support receipts taxable income?

+In most cases, child support payments received by the custodial parent are not taxable income. They are considered a reimbursement for child-rearing expenses and are not treated as income.

How are child support payments calculated?

+Child support payments are calculated based on factors such as the income of both parents, the number of children, custody arrangements, and child-related expenses. It’s important to consult your state’s guidelines for specific calculation methods.

What happens if a parent fails to pay child support?

+If a parent fails to pay child support, various enforcement mechanisms can be employed, including wage garnishment, interception of tax refunds, passport denial, and driver’s license suspension. These measures aim to hold parents accountable for their financial obligations.

Can child support orders be modified?

+Yes, child support orders can be modified if there is a significant change in circumstances. This could include changes in income, custody arrangements, or the child’s needs. To modify an order, a parent must file a motion with the court and provide evidence of the changed circumstances.