Trump Crypto Portfolio

In the ever-evolving world of cryptocurrency, it's no surprise that even former US President Donald Trump has dipped his toes into the digital asset market. While his crypto portfolio may not be as well-known as his business ventures, it is an intriguing aspect of his financial endeavors. Let's delve into the world of Trump's crypto investments and explore what we know so far.

Trump's Crypto Journey

The former president's interest in cryptocurrency has been a topic of discussion for some time. While he has not publicly confirmed the extent of his crypto portfolio, several reports and speculations have emerged, shedding light on his potential investments.

One of the most notable mentions of Trump's crypto involvement came from Steve Bannon, his former chief strategist. In an interview, Bannon claimed that Trump had invested in Bitcoin and believed in its potential. This statement sparked curiosity among crypto enthusiasts and investors, leading to further investigations into Trump's crypto activities.

Bitcoin: The Centerpiece

It is widely believed that Bitcoin (BTC) forms the core of Trump's crypto portfolio. As the first and most well-known cryptocurrency, Bitcoin has garnered attention from investors worldwide, including prominent figures like Trump.

Bitcoin's decentralized nature and potential for high returns have made it an attractive investment option. Its value has seen significant fluctuations over the years, making it a risky yet potentially rewarding asset. Trump's interest in Bitcoin could be driven by a desire to diversify his investment portfolio and capitalize on the growing popularity of digital currencies.

Other Crypto Assets

While Bitcoin may be the standout asset in Trump's crypto portfolio, it is likely not the only one. The crypto market offers a wide range of digital currencies, each with its unique features and use cases.

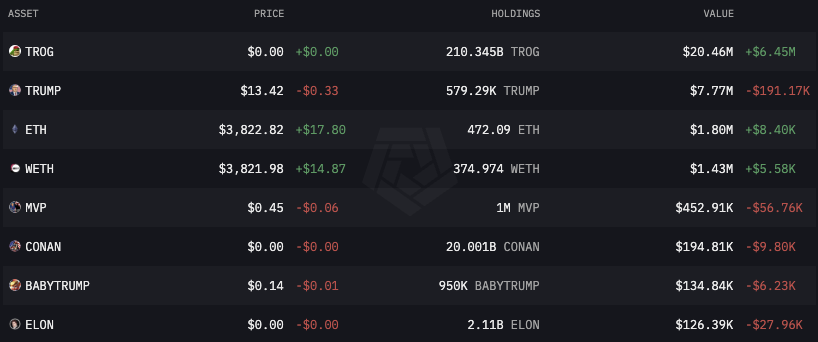

Ethereum (ETH)

Ethereum, often referred to as the "world computer," is another popular cryptocurrency that Trump might have invested in. Ethereum's blockchain technology enables the creation of smart contracts and decentralized applications, making it an innovative force in the crypto space.

Stablecoins

Given Trump's business background, it is plausible that he has allocated a portion of his crypto portfolio to stablecoins. These cryptocurrencies are designed to maintain a stable value, often pegged to traditional fiat currencies like the US dollar. Stablecoins provide a more stable investment option, reducing the volatility associated with other cryptocurrencies.

Blockchain Projects

Trump's investment strategy may also include allocating funds to blockchain projects with real-world applications. These projects aim to revolutionize various industries, such as finance, supply chain management, and data storage. By investing in such projects, Trump could potentially benefit from the growth and adoption of blockchain technology.

The Benefits of Crypto Investments

Trump's decision to invest in cryptocurrency could be driven by several factors. Here are some potential benefits he might have considered:

- Diversification: Crypto assets offer a unique opportunity to diversify investment portfolios. By including cryptocurrencies, investors can reduce their exposure to traditional markets and hedge against potential downturns.

- High Returns: The crypto market has witnessed significant growth and volatility, presenting the potential for high returns. Trump, known for his business acumen, may have seen crypto as an attractive investment opportunity.

- Global Reach: Cryptocurrencies are borderless and can be accessed by anyone with an internet connection. This global reach allows investors like Trump to participate in a rapidly growing market with a wide user base.

Risks and Considerations

While crypto investments offer potential rewards, they also come with risks. Trump, like any other investor, would need to carefully consider the following factors:

- Volatility: The crypto market is known for its high volatility. Prices can fluctuate rapidly, leading to significant gains or losses. Trump would need to have a risk management strategy in place to navigate these market dynamics.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving. Different countries have varying approaches to crypto, and this uncertainty can impact the market's stability. Trump would need to stay informed about regulatory developments to make informed investment decisions.

- Security Risks: Crypto investments are not without security risks. Hacking incidents and scams are common in the crypto space. Trump would need to ensure the security of his investments by using reputable wallets and exchanges.

Trump's Crypto Strategy

It is challenging to determine Trump's exact crypto strategy without his public confirmation. However, based on his business background and the nature of the crypto market, we can make some educated guesses.

Trump's approach to crypto investments may involve a combination of long-term holdings and short-term trades. He could have allocated a portion of his portfolio to long-term investments in established cryptocurrencies like Bitcoin and Ethereum, while also exploring newer, high-potential projects.

Additionally, Trump's investment strategy might focus on the underlying technology rather than just the speculative aspect of cryptocurrencies. He could be interested in blockchain projects that have the potential to disrupt traditional industries and create new economic opportunities.

The Impact of Trump's Crypto Investments

Trump's involvement in the crypto market could have a significant impact on the industry. His status as a former world leader and business magnate brings attention and credibility to the space. Here's how his investments might influence the crypto world:

- Mainstream Adoption: Trump's investments could encourage more people to explore and invest in cryptocurrencies. His influence could help crypto gain mainstream acceptance and attract institutional investors.

- Regulatory Changes: Trump's involvement might also prompt governments and regulatory bodies to take a closer look at cryptocurrencies. This could lead to the development of clearer guidelines and regulations, providing a more stable environment for crypto investments.

- Market Volatility: On the other hand, Trump's investments could also impact the crypto market's volatility. As a high-profile investor, his moves could influence market sentiment and potentially cause price fluctuations.

FAQs

Is Trump's crypto portfolio publicly disclosed?

+

No, Trump has not publicly disclosed the details of his crypto portfolio. Information about his investments is based on speculations and reports from various sources.

Why did Trump invest in cryptocurrency?

+

Trump's decision to invest in cryptocurrency could be driven by factors such as diversification, potential high returns, and the global reach of crypto assets.

What are the risks associated with crypto investments?

+

Crypto investments come with risks like volatility, regulatory uncertainty, and security concerns. Investors like Trump need to carefully manage these risks.

How might Trump's crypto investments impact the market?

+

Trump's investments could bring mainstream attention to crypto, influence regulatory changes, and potentially impact market volatility.

While we await further insights into Trump’s crypto portfolio, his involvement in the digital asset market highlights the growing appeal of cryptocurrencies among prominent figures. As the crypto space continues to evolve, it will be interesting to see how Trump’s investments shape his financial journey and influence the industry as a whole.