Trump's Federal Reserve: A Comprehensive Guide To Understanding The Us Monetary Policy

The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. It plays a crucial role in shaping the country's monetary policy and has a significant impact on the economy. Under the Trump administration, the Fed's policies and decisions have been a subject of interest and scrutiny. In this blog post, we will delve into the intricacies of the Fed's role, its structure, and the key aspects of US monetary policy during the Trump era.

Understanding the Federal Reserve

The Federal Reserve is an independent government agency responsible for regulating and overseeing the nation's monetary system. Its primary objectives, as outlined by the Federal Reserve Act of 1913, are to:

- Maximize employment

- Stabilize prices

- Moderate long-term interest rates

The Fed's structure consists of several key components:

The Board of Governors

The Board of Governors, based in Washington, D.C., is the main decision-making body of the Federal Reserve. It comprises seven members, known as Governors, who are appointed by the President and confirmed by the Senate. These Governors serve 14-year terms, with staggered appointments to ensure continuity and independence.

The Federal Open Market Committee (FOMC)

The FOMC is the Fed's primary monetary policymaking body. It is responsible for setting the nation's monetary policy and consists of the seven members of the Board of Governors and five Reserve Bank presidents. The FOMC holds regular meetings to assess economic conditions and make decisions regarding interest rates and other monetary tools.

The Federal Reserve Banks

There are twelve Federal Reserve Banks located across the United States, each serving a specific geographic region. These banks are responsible for implementing monetary policy, supervising and regulating member banks, and providing financial services to depository institutions and the US government.

Monetary Policy Under the Trump Administration

During the Trump presidency, the Federal Reserve's monetary policy has undergone significant changes and faced various challenges. Here's an overview of the key aspects:

Interest Rate Decisions

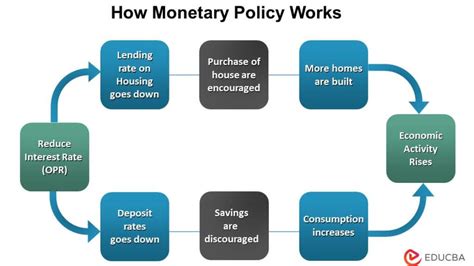

One of the Fed's primary tools for influencing the economy is adjusting the federal funds rate, which is the interest rate at which banks lend to each other overnight. During the Trump administration, the Fed has made several adjustments to this rate. In 2017, the Fed began a gradual rate hike cycle, raising the federal funds rate several times to combat potential inflationary pressures.

However, as the economy faced uncertainty and challenges, particularly during the COVID-19 pandemic, the Fed reversed course and implemented a series of rate cuts. These cuts aimed to stimulate the economy by making borrowing cheaper and encouraging investment and spending.

Quantitative Easing and Unconventional Measures

In response to the economic downturn caused by the pandemic, the Fed implemented a range of unconventional monetary policy tools. Quantitative easing, a strategy used to increase the money supply and stimulate the economy, was employed. The Fed purchased large quantities of government and mortgage-backed securities to provide liquidity to the financial system and support credit markets.

Forward Guidance

Forward guidance is a communication tool used by the Fed to provide information about its future monetary policy intentions. During the Trump administration, the Fed has been cautious in its forward guidance, aiming to manage market expectations and maintain stability. The Fed has emphasized its commitment to achieving its dual mandate of price stability and maximum employment.

Inflation and Price Stability

Maintaining price stability is a critical aspect of the Fed's mandate. During the Trump era, the Fed has faced challenges in managing inflation. While the Fed's target inflation rate is 2%, actual inflation rates have fluctuated. The Fed has implemented various strategies to address inflationary pressures, including adjusting interest rates and monitoring economic indicators closely.

The Impact of Trump's Monetary Policy

The Federal Reserve's monetary policy decisions under the Trump administration have had far-reaching effects on the US economy and financial markets. Here are some key impacts:

- Economic Growth: The Fed's accommodative policies, including low-interest rates and quantitative easing, have contributed to economic growth and recovery, particularly in the post-pandemic period.

- Stock Market Performance: The Fed's actions have influenced stock market trends. Lower interest rates often lead to increased stock market valuations, as investors seek higher returns in riskier assets.

- Housing Market: The Fed's policies have had a positive impact on the housing market. Lower mortgage rates have made homeownership more affordable, leading to increased housing demand and a boost in the construction industry.

- Dollar Strength: The Fed's monetary policy decisions can impact the value of the US dollar in the foreign exchange market. Changes in interest rates and market expectations can influence the dollar's strength relative to other currencies.

Challenges and Criticisms

While the Fed's monetary policy has aimed to support economic growth and stability, it has also faced challenges and criticisms. Some key points to consider include:

- Inflation Concerns: Critics argue that the Fed's accommodative policies may lead to higher inflation rates, potentially eroding the purchasing power of consumers and impacting the overall economy.

- Inequality and Wealth Distribution: Some argue that the Fed's policies benefit primarily those with access to financial markets, leading to a widening wealth gap and exacerbating economic inequality.

- Political Influence: The Trump administration's influence on the Fed has been a subject of debate. Appointments and potential political pressure on the Fed's decisions have raised concerns about the central bank's independence.

Notes

🔔 Note: The Federal Reserve's monetary policy is a complex and dynamic process. This blog post provides an overview of key aspects, but for a deeper understanding, readers are encouraged to explore official Fed resources and economic analyses.

🌐 Note: Stay informed about the latest Fed developments and their impact on the economy by following reputable financial news sources and expert analyses.

Conclusion

The Federal Reserve's monetary policy under the Trump administration has navigated a challenging economic landscape, marked by both growth and uncertainty. The Fed's decisions have aimed to support economic recovery, stabilize prices, and achieve maximum employment. While the Fed's actions have had positive impacts on various sectors, criticisms and challenges remain. As the economic landscape continues to evolve, the Fed's role in shaping US monetary policy will be closely watched by policymakers, investors, and the public alike.

FAQ

What is the primary objective of the Federal Reserve’s monetary policy?

+

The primary objective of the Federal Reserve’s monetary policy is to promote price stability and maximum employment while moderating long-term interest rates.

How does the Fed’s monetary policy impact the economy?

+

The Fed’s monetary policy influences the economy by adjusting interest rates, which can impact borrowing costs, investment, and spending. It also affects the value of the US dollar and market expectations.

What is quantitative easing, and how does it work?

+

Quantitative easing is a monetary policy tool where the Fed purchases large quantities of government and mortgage-backed securities to increase the money supply and provide liquidity to the financial system. This helps stimulate the economy by making credit more accessible.